Since the rise of USDT in 2017, the world has quietly stepped into a new financial era — one where stablecoins are reshaping how capital moves, how sovereignty is exercised, and even how monetary policy works.

At the core, crypto is just a foundational technology — a toolkit. And like any powerful tool, it can be used in more than one way. Some applications, like real-world assets (RWA), have a built-in need for regulation and compliance. Once a token represents something tangible — a house, a bond, a barrel of oil — state oversight naturally steps in. But this is where the tension begins.

Crypto, especially when dealing with real-world finance, is a double-edged sword. On one hand, it relies on sovereign systems for legitimacy and enforcement. On the other, it chips away at the very control that sovereign states hold.

Take RWAs: they digitize real assets and, in doing so, make them globally liquid. That reduces a state’s grip on its domestic capital. Stablecoins go even further. They reduce a country’s control over its own money — its issuance, flow, and policy effectiveness.

We’ve seen this play out in real time.

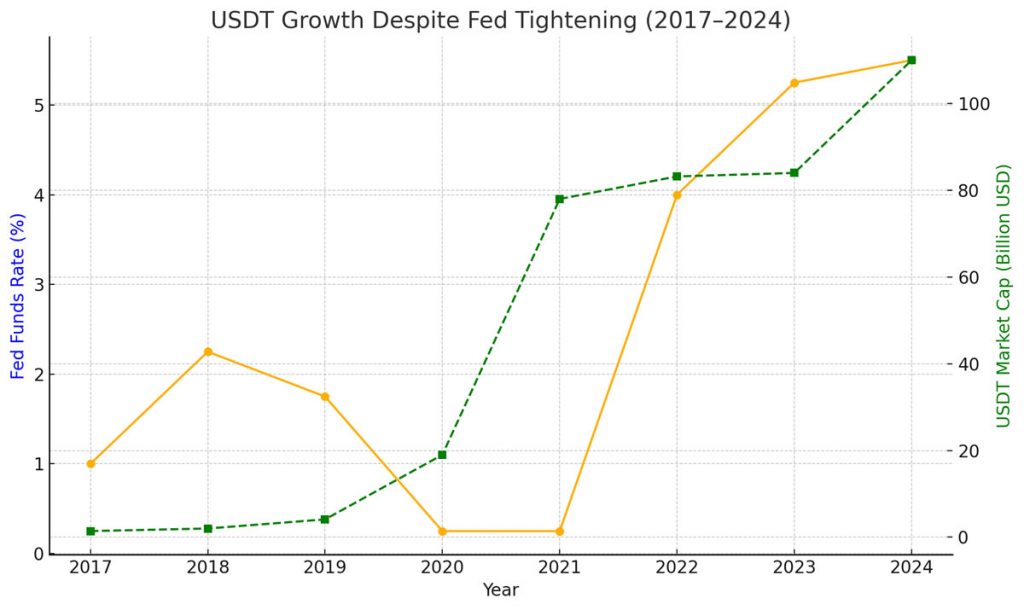

Case in point: Iran survived the Fed’s most aggressive rate hike in decades.

Historically, sharp U.S. rate hikes would crush economies from Southeast Asia to South America. But in the most recent tightening cycle, even countries like Iran with fragile economies stayed afloat. The waves of dollar pressure have weakened. Why?

Stablecoins.

They extend the reach of fiat dollars into places U.S. regulators can’t easily touch. They punch holes in capital controls and penetrate foreign banking systems with little friction. But at the same time, they serve as buyers of U.S. Treasuries — offering a steady demand for government debt.

Here lies the paradox: most proposed stablecoin legislation insists that these digital dollars must be non-interest-bearing. That’s the price of safety and predictability. But in a high-rate environment, this becomes a problem. Non-yielding digital dollars flood the market while the Federal Reserve tries to tighten. This undermines the very mechanisms central banks use to drain liquidity. It’s like trying to empty a pool while someone else is pouring water in through a hidden pipe.

In this sense, stablecoins act as a slow-acting poison to monetary sovereignty. And crypto, more broadly, is a kind of viral force — not malicious, but relentless. Like any major technological leap, it challenges the status quo.

But that’s also how civilization progresses.

Humanity has always chosen higher productivity and freer exchange.

From empires to republics, from landlines to the internet, the march toward decentralization and openness has been bumpy but one-directional. Power doesn’t like to give up control, but people don’t like to give up freedom either. The system might wobble, even regress temporarily, but it rarely reverses.

So yes, crypto might be disruptive. Stablecoins might weaken the levers of traditional power. But in the grand story of civilization, they’re just the latest chapter in a much older tale — the pursuit of efficiency, and the desire to be free.